Working Lease: How It Works And Differs From A Finance Lease

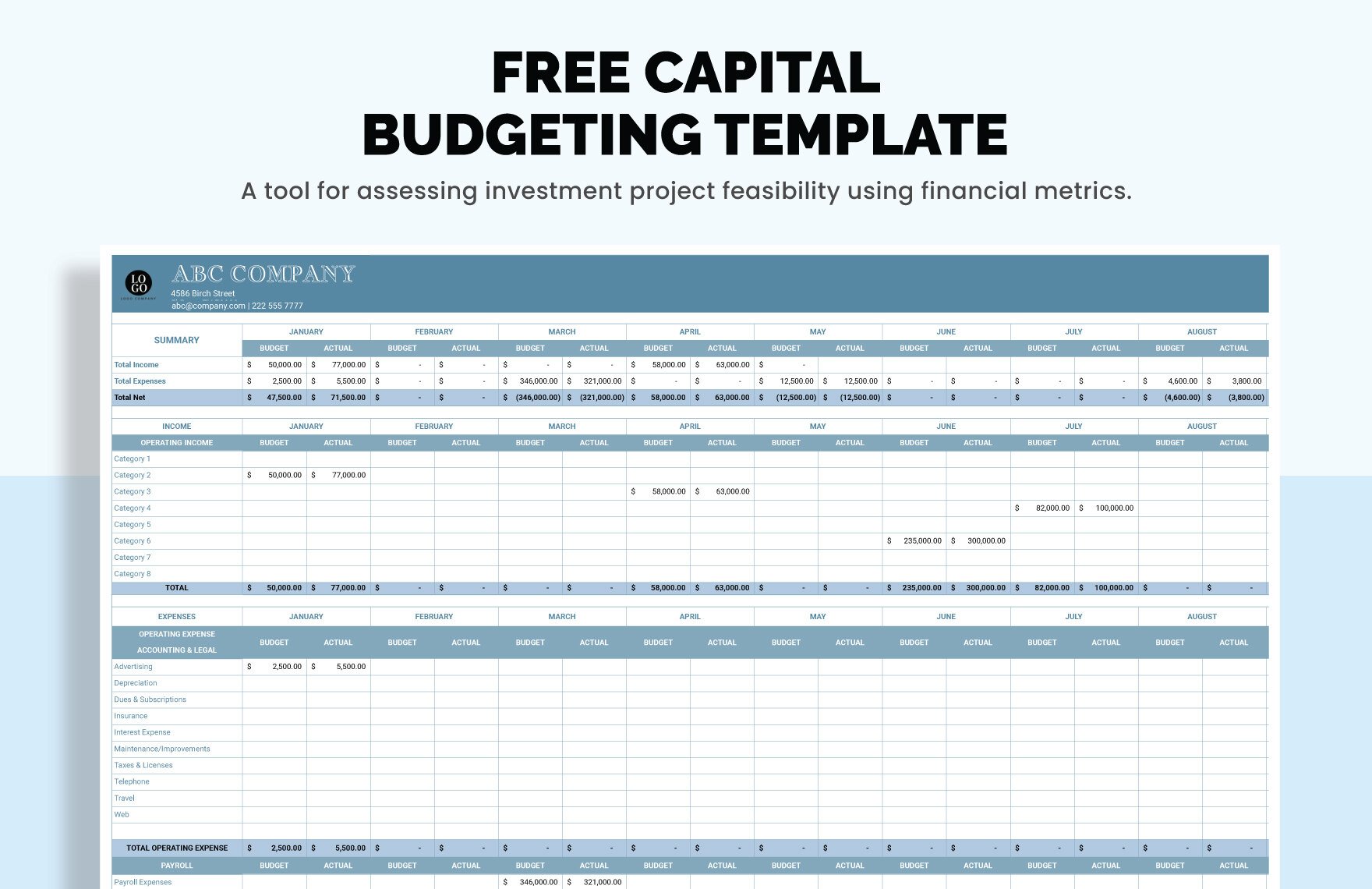

If title transfers to the lessee, the lease is classified as finance. It’s also price noting that beneath certain different accounting requirements, such as IFRS 16 and GASB 87, you don’t must make this distinction in any respect. Factors to think about include your monetary place, the type of asset needed, tax implications, and flexibility necessities. The choice between a Capital Lease and an Operating Lease is determined by your distinctive circumstances and monetary goals. Consult with your monetary advisor or accountant to determine which possibility aligns best with your company’s needs.

The liability lease expense represents the curiosity accrued on the lease legal responsibility each period and the asset lease expense represents the amortization of the lease asset. ASC 842 mandates that each finance leases and working leases be recognized on the steadiness sheet. In contrast, operating leases sometimes profit corporations that anticipate swapping out gear frequently or can not justify holding onto it for an prolonged interval. If your startup offers in dynamic technology—like advanced computing servers or mobile devices—a short-term operating lease spares you from stuck ownership when the next big upgrade comes alongside.

In Contrast To a capital lease, this construction is designed for flexibility and price efficiency. Working lease funds are handled as working expenses on the revenue statement, and are typically tax-deductible. Beneath ASC 842, working leases must appear on the stability sheet, however the influence is minimal in comparison with capital leases. Operating leases are often used for short-term or non-core property and typically have more flexibility in comparison with capital leases. It’s essential to know the difference between capital and operating leases.

Evaluating Capital Leases To Operating Leases

The asset is treated in the books similar to the lessee is the precise owner and is shown within the stability sheet. There are two forms of leasing process- Capital lease and Working Lease. Depending on the requirements of the enterprise and its tax situation, an organization may decide any of the lease types or perhaps a combination of each. Capital leases are accounted for as each belongings and liabilities on the lessee’s balance sheet. The leased merchandise is listed under property, plant, and gear (PPE) or an equivalent class, valued at either its honest worth or the current value of future lease payments, whichever is decrease. The Interior Revenue Service (IRS) may also reclassify an operating lease as a capital lease to reject the lease payments as a deduction, thus growing the company’s taxable income and tax liability.

And with Tango, you don’t simply get software program; you get a associate. We’re proper there with you all through the process—providing help, answering questions, and guiding you each step of the means in which to successful and compliant lease accounting. This often happens as a end result of the leased asset is highly specialised. For instance, a lessee may lease a custom-built piece of machinery that was designed specifically for his or her needs, however which would haven’t any utility exterior of their own use case.

The depreciation and upkeep of the automobile is the corporate responsibility – not the automotive company’s accountability. At the top of the lease settlement, the company can purchase the automotive and own it outright. A capital lease is a selected sort of renting contract between a lessor and lessee. The contract allows for the renter to use the asset for a temporary period. On the accounting ledger, the business will deal with the asset prefer it owns it. At the end of the lease term, the business has the opportunity to purchase the asset or return it.

- Then over time, you calculate the depreciation of the asset as a loss.

- Only yearly rental expenses are proven of their spending reports.

- Another angle to contemplate is that lenders or buyers might see capital leases as a sign of stability—indicating the business commits to important manufacturing infrastructure.

- Working leases, whereas traditionally advantageous for covenants, are actually subject to comparable scrutiny beneath up to date requirements.

Income Assertion Influence

This makes the steadiness sheet bigger because of the further funding. It additionally tracks the money the company owes due to the lease. Firms should make insurance policies about tips on how to apply the classification standards for leases.

Capital Lease Vs Operating Lease: The Primary Variations

Selecting between an working lease and a capital lease isn’t nearly money circulate or ownership—it also impacts your company’s tax strategy. The time period “capital lease,” used beneath ASC 840, is now known as a “finance lease” underneath ASC 842, maintaining the idea of serious asset ownership switch to the lessee. Examples of the assets, together with Aircraft, lands, buildings, heavy equipment, ships, diesel engines, and so on., can be found for purchase under capital lease. Smaller belongings are also available to be financed and are thought of beneath one other kind of lease called the working lease. Under this construction, the lessee data the leased asset and a corresponding liability on their steadiness sheet, emphasizing the monetary impact. In essence, a capital lease resembles a financing agreement that assigns many ownership responsibilities to the lessee.

Save 70% on employment prices, while driving high quality & growth. Outsource Accelerator is the main Business Process Outsourcing (BPO) market globally. We are the trusted, impartial useful resource for businesses of all sizes to discover, initiate, and embed outsourcing into their operations.

This ensures everyone follows the same rules and meets compliance. Taking care of leasehold improvements, incentives, termination choices, and different elements of a lease can be important. If the lessee is prone to personal the asset on the finish of the lease, it’s a capital lease.

Each lease sort impacts your company’s stability sheet, cash circulate, and tax technique in distinct ways. Operating lease payments are categorized as operating cash outflows, aligning with different https://www.simple-accounting.org/ enterprise expenses. A company may lease tools, like machinery, underneath phrases that qualify as a capital lease.